espp tax calculator canada

Depending on how your company handles taxes they may sell some of the. In general when we strip all the complexity away an employee will be taxed based on four factors.

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Calculate tax from Employee Stock Purchase plan My workplace has an Employee Stock Purchase Plan ESPP where we get a 15 discount off the stock price.

. Income tax and capital gains. Employee Stock Purchase Plan ESPP Calculator Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming. If an excess amount has been contributed to a specified employees EPSP in 2021 the excess EPSP amount is subject to a special tax.

Ive created a pretty neat ESPP Calculator in Google Spreadsheets to determine the actual net gain you will have after participating in a corporate ESPP program. In this example as in the previous one the sales price you report on. That is good because long-term capital gains are taxed at a rate that is lower than your regular tax rate.

An ESPP enables your employees to purchase shares in your company or your parent company at a discount. The taxable benefit is the. The capital gains on a stock is from your purchase of stock usually done with the after-tax money.

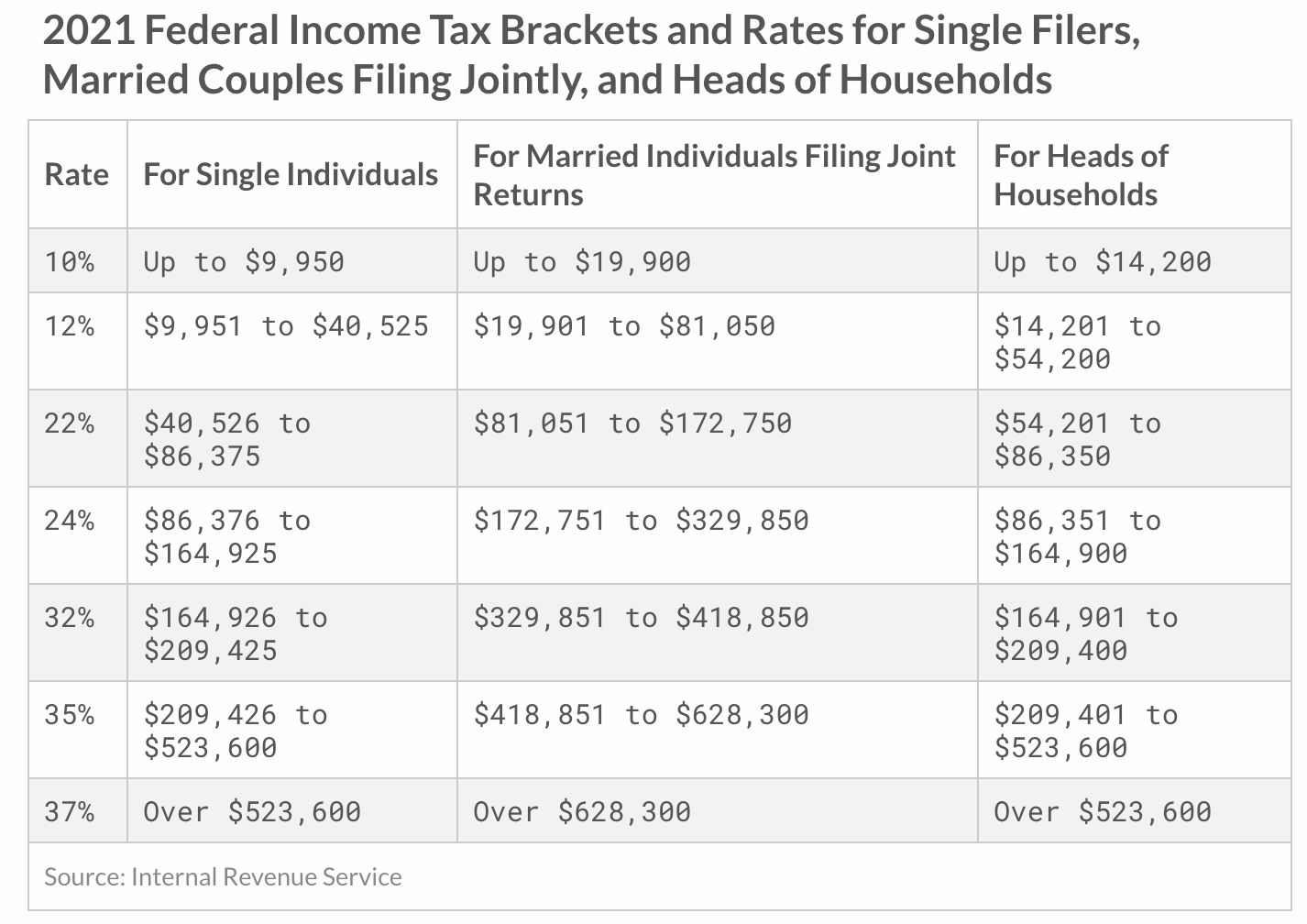

The 1000 benefit 500 shares x 12 10 is treated as employment income and will be taxed at your marginal tax rate. In the above table the Estimated Taxes is based on a 22 tax rate on the 316592 profit. In Canada and the US there are two forms of tax that.

Market Price on the. First Day of Subscription Period Market Price on the First Date of Subscription Period. A specified employee is a person who.

This calculator actually also. Starting in 2011 the Canada Revenue Agency. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription period.

Like all income we earn the government wants its cut from your ESPPs and RSUs. Most people have trouble calculating adjusted cost basis for filing taxes. That means that your net pay will be 37957 per year or 3163 per month.

Your average tax rate is. This calculator will help with that. The purchase is funded through deductions from the.

How Employee Stock Purchase Plan ESPP Taxes Work An ESPP is a fairly straightforward program that only gets complicated when introducing taxation into the. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. For Canadian tax purposes when youre buying shares in an ESPP you need to calculate the adjusted cost base ACB for all the shares you have purchased over the years.

Employee Stock Purchase Plan ESPP Calculator It is an online tool for tax calculation and used to determine your net gain after tax value on your ESPP based on grant date exercise date. Every benefit is taxed at your marginal tax rate in Canada. The length of time the stock is held The price the stock is purchased at.

For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1.

Espp Gain And Tax Calculator Equity Ftw

When Should You Sell Espp Shares Equity Ftw

The Mystockoptions Blog Tax Returns

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

The Employee Stock Purchase Plan Is Part Of Your Compensation Brewing Fire

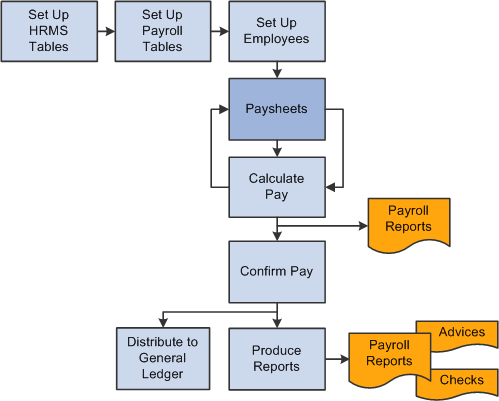

Peoplesoft Payroll For North America 9 1 Peoplebook

Carver Edison Ownership For All

Restricted Stock Units Jane Financial

Salesforce S Espp Is Worth Maxing Out Equity Ftw

Employee Stock Purchase Plan Espp The 5 Things You Need To Know

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Solved Does Turbo Tax Premier For Investments Adjust Espp Cost Basis To Avoid Double Taxation In The Case Of A Disqualifying Disposition

Understanding Employee Stock Purchase Plans E Trade

Qualified Vs Non Qualified Espps Global Shares

The Minimal Investor Espp Guide And Calculator Minafi

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Taxation Of Stock Options For Employees In Canada Madan Ca